|

No-2014/3 |

Author: Vugar Bayramov |

THE DIVERSIFICATION OF AZERBAIJAN ECONOMY; WAYS TO EUROPEAN INTEGRATION

The diversification need of Azerbaijan’s economy has long been debated since 2005, when the oil revenues fuelled economy’s development on one-engine shadowing non-oil sector. This situation has not changed up to date, as Azerbaijan’s economy; GDP, budget revenues and governments’ investments still depend heavily on oil revenues. As many authors cite harmful effects of economic concentration, even more arguments are provided for negative consequents of concentration on natural resources, especially on abundant, but non-renewable energy sources. These negative effects (I) for society are (1) resources course, (2) delayed modernisation and (3) entranced inequality, (II) for economy are (1) low profitability, (2) less perspectives for future growth, (3) and underdeveloped economic sectors.

First of all from the very concentrated economy society suffers because of resources curse. Resources curse implies that, paradoxically, nations with plentiful natural resources are the ones suffering from low economic growth: ideally they could use their resources for their development. This is result of many factors as, including but not limited to, mismanagement, weak institutions, and/or lack of knowledge. When the growth sourced from single source the society suffers from the delayed modernisation, as well: the elite controlling revenue source try to prevent economic diversification with the purpose of preventing emergence of alternative powers and sources. Thus society suffers from underdeveloped economic and social situation. However this is not the last perk of concentration. Society also suffers from entrenched inequality: elite controlling revenue sources lead society to gap among social strata. Wealth people get wealthier, while others poorer.

Apart from social harms of concentration, the economy also suffers from underdevelopment. The so called rentier effect: The more oil revenues come into country, the stronger the local currency becomes. As the local currency appreciates it hurts exports in all of economic sectors. Low profitability of economic sectors is also among consequences of the non-diversification.

Having said negative effects of economic concentration, one shall analyse the situation in Azerbaijan.

Azerbaijan economy could be classified into oil and non-oil sector, because of their shares. Although until the early 2000s the non-oil sectors were weighted more in economy, since 2005 the oil sector took the leading position. The first burdens of this one-engine growth came during 2007 – 2009 crises, when oil prices did drop to USD 36 from USD 100. This made the government rethink about economic diversification. Up to 2012 the energy sectors share in the economy was higher than cumulative total for all non-oil sectors. Thus, fostering the development of non-oil sector in Azerbaijan is matter of utmost importance. For Azerbaijan’s strategy through 2020 entitled ‘’Look into the future’’ is the diversification as top goal for economic development. However, the occured problem is about deciding what sectors other than oil sector are more profitable and should be prioritized.

The economic diversification is the one of the most important goals in the economy of all developing countries even including well-developed countries as well in order to get sustain on economic growth. The aim of this paper is assessing the diversification of economy and competitiveness among the sectors in the domestic economy of Azerbaijan. Hereby, the researchers will try to find out the answers to the questions according below :

Throughout the article, these questions are not analysed for regional diversification but sectorial diversification. And to quantify the sectorial diversification researchers, have calculated ‘’Ogive index’’ for the GDP in sectors. It is worth of mentioning, for sectorial employment diversification the Herfindahl-Hirschman Index has been employed. Ogive index was introduced by Tress in 1938. Then other economists, such as Hackbart and Anderson (1975), Attaran and Zwick (1987) applied this method to measure the diversity in economy of different countries.

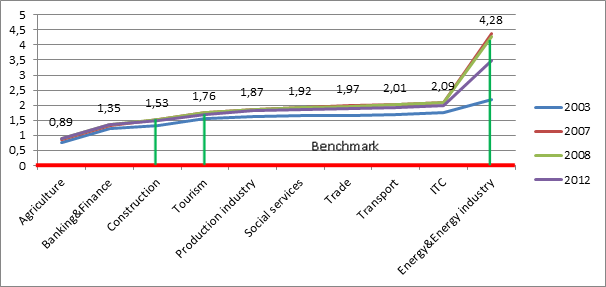

The definition of ‘’Ogive index’’ is:

Where:

Pi is sectorial share of GDP in total GDP ;

N – is the total number of sectors in the economy

In other words, 1/N is the ideal share of any economy: If economy has 4 sectors, ideally each sector shall have 25% share. If one deducts this ideal share from actual share of all sectors, they will end up with: how sectorial share are different or deviate from from their equally diversified shares. Summing up these deviations, and finding their average value by dividig by N, gives us the Ogive index for the sector. If the result of Ogive index is 0 (zero) the diversity of the economy is high, i.e equal, otherwise, and the results larger than 0 indiates less diversity of the economy.

The second quantative method has been employed by the researchers is Hirschman (1964) Herfindahl (1950) Index (HHI) which measures not only market concentration and to examine existence of oligopoly in industrial economy, but also to evaluate economic diversity and for macroeconomic specialization. The index is given with following formula:

![]()

Where:

S – sectoral share

N – number of sectors

From the equation above we should obtain that If there is equal employment share in the each industry, the result of the equation will be the lowest degree, otherwise the result will be the highest degree If there is concentration in one industry, like a monopoly. So the higher the figure is, the less diversified economy.

For an addendum to the quantative method, one of the econometric model has been used by the researchers which is named Vector Autoregression Model (VAR) to generate forecasts of economic variables , such as GDP and to examine the effects of economic shocks. Estimating the VAR, helps us to answer the influence of exogenous variables such as government spending, refinancing rate, money supply, tax exemptions and subsidies to GDP and Investment. The movement of endogenous variables within VAR which is the effects of exogenous variables shock, the VAR can be used as an instrument to investigate these shocks.

Qualitative method seeks answers to research questions on the economy using non-numerical information such as interviewing prominent experts. As a result the lists of sectorial guidelines are prepared based on the interpretations and observations of these experts on current conditions and further expectations for the future. Experts include independent analysts and representatives of government agencies. Government representatives were given special attention as they were the owners of firsthand information on government’s sectorial policies. Getting all information did play a big role for the researchers while drafting sectorial proposals.

In addition to the HHI and Ogive indices, researchers used the Vector Autoregression model (VAR) to assess impacts of economic variables (particularly GDP) and to investigate the effects of economic shocks. According to the Bank of England (2013), the VAR is a dynamic system of equations that estimates the relationships among economic variables by determining the linear dependence among a multiple time series. In the model, we consider some endogenous variables together, and it calculates the simultaneous equations explaining that each variable own lagged or past values and lagged values of all independent variables. In the early 1980s, the VAR was mainly developed as a modeling tool by Christopher Sims. To estimate the equations in the models in advance, we have to make sure that the predetermined (exogenous) variables are current only in some equations. However, Christopher Sims did discover a framework that criticizes the traditional approaches. Sims and his followers argued that if there is a real simultaneity among a set of variables, they should be used on an equal footing and we would not see any disparities between endogenous and exogenous variables. In a univariate Auto Regression there is single-equation and single-variable model where the present value of the variable is explicated by its own lagged values. The VAR, which is consist of n-equation, n-variable linear model where all variables are in turn explained by their own lagged values, including present and past value of the remaining n-1 variables. This is Sims’ approach to this econometric model.

Estimating the VAR helps us analyse the influence of exogenous variables such as government spending, refinancing rate, money supply, tax exemptions, subsidies to GDP and investment. The movement of endogenous variables within VAR, which is the effect of exogenous variables shock, can be used as an instrument to investigate these shocks.

The model is best at answering questions such as:

The VAR, however, has the following weaknesses:

As discussed, researchers have used the variables below as input figures. It shall be noted that each variable was different in different sectors. And some sectors had no information in a couple of given variables. Thus, researchers dropped these variables and generated the sectorial VAR equation without these factors.

These variables are abbreviated in the model as follows:

Having Monetary Policy and sectorial fiscal policy indicators regressed with sectorial GDP and investments allows researchers to argue if a particular fiscal policy, say tax exemptions in Agriculture has been creating GDP or destroying it, or attracting investments to the sector or not.

As an output, the VAR model generates the following figures as coefficient, standard error and tests for each variable pairs, R-squared, Adjusted R-squared, Sum of Residuals, F-statistics, Akaike Information Criterion (AIC), Schwarz Criterion (SC) and other figures for each sector.

Coefficients of variable pairs measures degree of impact of a one-point change in independent variable in dependent one(s). E.g., a coefficient of four of investment and GDP pair shall be interpreted as a one-point change in dependent variable is reflected in the four-point change in GDP, holding all other independent variables constant. The signature of the coefficient indicates positiveness or negativeness of the impact: a negative (positive) coefficient of four would imply a one-point increase in investment will result in four-point decrease (increase) in GDP.

The standard error of variable pairs measures the deviation in estimation of the calculated coefficient to correctly predict the actual figures. Although there is no benchmark to compare and infer from the standard error, the lower error is the better regression equation.

T-test for variable pairs are the “t-calculated” values calculated by the software on coefficients. T figures are for conducting a hypothesis test on statistical significance of the variables, independently. The hypotheses for this are:

The R-squared figure defines the goodness of the fit of regression line, i.e., how good the estimated line is at explaining the given data. The closer to 1 the fitter and better the model is. Adjusted R-squared is introduced to prevent many independent variables from inflating the R-squared figure. In contrast to R-squared figure, the Adjusted R-Squared figure measures the true goodness of fit in multiple regression analysis and its robustness against multicollinearity issue.

The sum of residuals is used to define the goodness of the fit: how much of the change in dependent variables is explained by independent variables? The higher degree of explanation, the better the fit is. However, the figure is not the ratio, making it hard to measure the extent of the explanation.

F-statistics, Akaike Information Criterion and Schwarz Criterion are the three measures to define the model specification. By model specification it is assumed the goodness of the model in explaining the given data. Given two models, the model with higher F-statistics and lower Akaike and Schwarz Criterion are defined as the best explaining models. This was the decision-making criterion in model specification. The model lowering Akaike and Schwarz values and maximizing the F-value was chosen for the analysis.

Having provided the necessary information to understand the methodology, we discuss the results in the next section, which starts with an analysis of economic diversification and is followed by the assessment of sectorial policies.

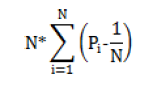

The economy’s employment diversification has been implemented via application of HHI index. To make comparatively analyse, the benchmark should be built up which means if the economy is equally diversified among 10 sectors, the HHI index has to be 10 (or 1000%) for each sector. The figure below, depicting HHI index expresses that, in the sectors of agriculture, social services and trade, the diversification of labour faces distortions. This means, HHI index goes up rapidly in those sectors. Compare the peak (22.71) with the HHI index of equally shared economy: 10. Thus in terms of labour Azerbaijan’s economy lacks a diversification.

Figure 1 HHI index of sectorial employment for 2010, 2011 and 2012

Source: State Statistics Committee of Azerbaijan Republic and Author’s Own Calculation

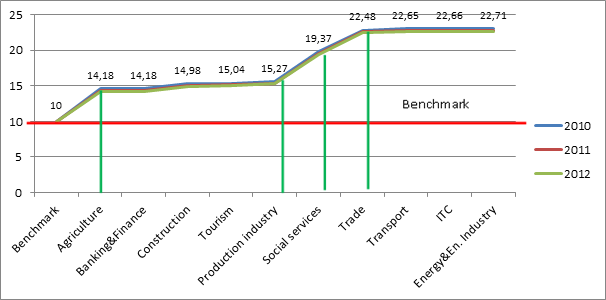

In order to analyse the diversification of sectorial GDP, as noted above, the Ogive index has been implemented. The researchers provides readers with index for 4 years to give clear, comprehensive but not complex picture, as inclusion of all years would make the chart unreadable. Those years are:

To understand the result of the definition, it has to be known that, if the index close to 0, it means economy has better diversity. When the index touches to 0, means economy fully diversified.

Figure 2 Ogive index of GDP diversification

Source: State Statistics Committee of Azerbaijan Republic and Author’s Own Calculation

As the index represents, the economy of Azerbaijan is relatively diversified than without tourism and energy/energy industry sectors. Paying attention to the graph, it is observable that, when those sectors added to the graphs, the index does peak. However, in 2003 energy and energy industry distorted economy less than in 2007 or 2008. Interestingly in 2012 the energy/energy industry’s slope is decreased indicating the lesser dependency from the sector in 2012, compared to 2007/8. But still the index is well above 0 implying non-diversified GDP.

These two indices imply that Azerbaijan economy is diversified neither in terms of GDP nor employment. Thus researchers interviewed local experts on policy recommendations for sectorial development. The compiled proposals, including CESD view, are provided below and disucssed after short overview of key sectorial points:

Azerbaijan finance system became independent in 1991, after USSR. Since then bank system is two-tiered : Central Bank and retail banks. Central Bank customizes the activities of banks in the second tier. The development of banking system could be divided into two-phases which is the first period is 1990s and early 2000s, the second is from 2005 until now. In the beginning of independence of Azerbaijan, the role of banking sector in the economy was not very high. The World Bank and IMF made special help to the Azerbaijan government in the first phase of development. In 1994, the Manat became legal tender in the circulation of economy. The first aim of the government was to make environment more competitive for this sector to reach development. The economy faced its the highest inflation rate in the second phase, 2006. The Government did change the denotation of the manat in the scale of 1:5000.The Central Bank (firstly named National Bank of Azerbaijan) which was established in 12 February, 1992, to support sustain economy, made the Exchange rate of manat compared US dollar, approximately stable. During 2007 – 2009, in banking sector, Azerbaijan got a lot of profit. Beginning from 2009 profits from the financial sector began to decrease, because though crisis did not affect directly financial sector in 2007, but began to worsen the activity of other economic sectors, as a result, credit risks became higher and the sector became full of non-performing loans, so crisis’s great negative impact on both financial and economic sector became visible only after 2009 till 2011. Beginning from 2011 financial sector began to regain its prior economic power.

Based on the model results and expert interviews, the refinancing rate harms the GDP in the sector. On top refinancing rate, the independent experts interviewed took an alarming approach on loan rates as well, arguing it is too high to be lowered for the sake of supporting entrepreneurship and the sectorial development. On the other hand, the Central bank’s monetary policy fosters growth in the sector by an amount almost equal to the negative effect of the refinancing rate. Lack of access to international financial markets also among the reasons hampering competition in financing sources and limits alternative financing. One of experts argued that, shadow control of the banks plays important role in their underdevelopment[2]. The sale of government securities are realised mainly thanks to banks. On top of this, banks are reluctant to develop in themselves: Excluding a couple of retail banks and, most of banks show no drive to create new products or innovations. This is borne out by the lack of competition as well.

The usage of Azerbaijan’s national top-level domain AZ did a great positive effect of this sector. The competitive market always make a sector tend to development, because of this tendency, the government took away the barrier in 2000, which was the requirment for licence. Now, there many providers in the sector that do compete. The trend of value added in information and telecommunication sector is upward, in 2005-2008 it increased sharply, but at the beginning of 2009 the gradual increase was observed. Gross and net operating surpluses increased in 2005-2009 and a gradual decrease in 2010 and then upward trend in 2011-2012 was observed. Investments in the fixed capital and local investments decreased in 2009 due to global economic and financial crisis that affected all world economy, as well Azerbaijan’s economy. There is no information about the amount of foreign investments in 2009 and 2010, but in other years the growth was observed and the trend was upward. Employed population in the information and communication sector (in per cent to total) nearly remained the same around 1% between 2005 and 2009 (SSC, 2013). There was a slight increase in 2010 in the amount of the people working in the information and communication sector to 1.29%, but then number of workers again remained stable for 2011. Volume of communication services has been increasing since 2000, and in 2011 the gross amount of communication services was nearly 8 times more than the amount of the same indicator in 2000. Volume of services on information had been increasing due to the growing volume of mobile communication services, which is the biggest and main part in communication services. The last global financial crises affected this sector as well in 2010. From 2011, there is observation that which shows increasing in the sector.

According to experts, government takes the largest share of the IT sector. Just three of fifty ISPs (Internet Service Provider) are state owned and yet account for more than forty per cent of the sector`s GDP. This view is also supported by our model with its positive correlation of government spending with sectorial GDP. Apart from this, experts believe that current strategy is not enough to foster the growth in the sector. In their view, the IT sector needs to shift from services to production. Right now Azerbaijan`s IT GDP is generated only by sales of its services. Experts believe that IT cannot be labour consuming and a sector with diversification potential just with IT services. In order to make the sector productive, labour consuming and GDP contributive sector, IT needs to have its own factories to produce different electric appliances and employ the graduates of local IT universities of Azerbaijan. According to independent experts, Azerbaijan should not strive to compete with developed countries in the satellite sector but rather should concentrate on building cluster infrastructure. In order to achieve this, prominent expert believe that an independent supervisory entity should be established to lessen government influence and maintain enough control. Failure to establish this entity will result in further brain drain and loss of growth opportunities in the sector.

Construction sector is second largest sectors which have a positively GDP of the country in the past. In 2005, the sector did reach its maximum amount of value added in the share of GDP. After the given period, the share of the indicator in the GDP began to fall and got its minimum amount in 2007. Then the share of the indicator again began to increase and got its maximum amount in 2010. The construction sector was the worst witness of global economic crisis. Others sectors of the economy have not suffered so much as the construction sector and the bad impact of the degradation of the sector due to sudden lack of customers and capital negatively affected main social-economic indicators of the sector. Investments involved in the construction and installation works are divided into two parts by the territorial parameter: domestic and foreign investments. In this sector, the highest per cent of foreign investment was observed in 2003, which was 75.2%, where the domestic face the minimum share, but in from 2003 until 2011, there is increasing in domestic investment which the amount did reached its peak level, 79.7% where the foreign is the minimum.

The construction sector has very good potential for development and big problems for development. This problem is reflected in high import costs of raw materials in the construction sector. In other words, like the IT sector, the construction sector is also based on services that are not labour consuming. The government of Azerbaijan can achieve large scale employment and industrial growth by facilitating local production of imported materials.

Agriculture is the sector where the concentration of workforce is at its highest level with 37.9%. The Government have applied poverty reduction and socio-economic developments programs that led to increase in the sector. According to State Statistic Committee, there is observation of progress covers 2000 till 2008. As mentioned above, the last financial crises had negative effect on this sector as well, which the amount of agriculture faced decreasing. But the programs which employed, did help sector to regain its productivity in the economy. On August 2004, the state programme “Investments to Agrarian areas” which signed between Azerbaijan Government and World Bank, caused increasing on the rate of employment, as 78 branch of banks were established to financing agricultural activities via SME financing. According FAO Azerbaijan has been much less affected by the global economic crisis than the other countries of the region and Azerbaijan is also classified by FAO among the countries with a very low level of hunger, i.e. less than 5% of undernourishment. Azerbaijan Government, after 2009, did employ some important programs which are listed below, give positive effect to the sector: “the State Program of Socio-Economic Development of the Regions of Azerbaijan (2009-2013)”, “the State Program of Poverty Reduction and Sustainable Development of the Republic of the Azerbaijan”, “ the State Program of Ensuring Reliable Population in the Republic of Azerbaijan in food provision” (2008-2015) and others.

Experts believe profit margin is very low in the sector. This affects everything, including, but not limited to, motivation, competition, and export potential. This problem is exacerbated by lack of reasonable access to capital and new technology. Illiteracy among farmers affects their export quantity and quality as well. Without an adequate understanding of agricultural products, farmers cultivate and grow items with low export potential. In order to achieve GDP growth in the sector the government should immediately cut subsidies (which negatively affect sectorial GDP) and increase government spending in the sector with even further tax exemptions. By eliminating trade intermediaries and achieving direct sale of goods at market prices by farmers themselves, the government could ensure that farmers maximize returns from production. On top of this some portion of highly fertile lands are under occupation, leaving no option but to lose opportunity to cultivate quality foods. Also the low proportion of per capita arable lands and weak legal environment for agricultural activities are also among problems hampering the sectorial development.

There is a great potential in Azerbaijan for tourism sector, because of its natural resources, climate, history etc. The Caspian Sea makes an indispensable chance to develop the sector. Recreational and entertainment facilities are widespread in Azerbaijan. Tourists mostly come from CIS countries as European countries consisting of little percentage of tourists. According Ministry of Tourism for last information number of foreign guests increase to 1 mln in 2012. The program, adopted by the Government of Azerbaijan, titled “Development of Tourism in the Republic of Azerbaijan for 2002-2005” created favourable conditions for the development of tourism, integrated the sector with international tourism market. As a result of this state program, the positive effect was observed on the rate of employment in the tourism sector, which rate increased approximately five times. The programs, have been employed by the government, have created investment potential for Azerbaijan as well. According to the Azerbaijan Export and Investment Promotion Foundation (Azpromo) as per implementation of state programs the sector is investment efficient. The reason, why the investors should give high consideration, is about location where Azerbaijan is favourable location between Europe and Asia, create potential to attract tourists from Russia, Central Asia, Iran and Europe.

An expert among all interviewed experts about the future prospects of tourism in Azerbaijan emphasized its natural beauty: “We just need good management to benefit from this beauty”. When asked what “good management” meant, the expert interpreted it as establishment of a competitive sector. Generally, experts outlined the following points for future development of the sector:

Human capital, labour resources and potential internal demand, create high facility for Azerbaijan. Hereby, the industry is one of the most developed sectors in the domestic economy. Since Azerbaijan became independent in 1991, industry sector is more profitable for the country. This lead to signature of production sharing agreements on oil and gas fields with foreign companies by Azerbaijan in 20 September 1994. These agreements and other reforms undertaken by the government encouraged sector’s rapid growth. The industry benefited from radical changes during 1995-2008. In addition, from 1995 to 2008, non-state sector in gross production of sector increased from 5.5% to 75%. During 2008 – 2012, oil industry exceeded the whole non-oil sectors’ development. According to International Labour Organization, employment in the industry has declined sharply, from 23% in 1990 to 9% in 2007.

Experts believe industry is the most important sector for development in the economy. However, the sector is in a precarious situation presently. More than 80% of the sector is oil-dependent. These experts compare the share of oil in industry in 1990 (4.8%) with that of the 2010s. These experts believe this shift transformed the country into an exporter of raw materials. They believe that with the same transport, insurance and other non-production related costs Azerbaijan can export more finished goods instead of raw materials at a substantially higher margin (measured by 4x). According to other experts, shifting from the mere sale of oil to the sale of oil products is beneficial because of the following reasons:

The transport sector has main portion in GDP in the economy of Azerbaijan in recent years. This sector also provides a flow of income from transit services, and promotes the development of domestic and foreign trade. The transport sector in Azerbaijan includes air traffic, waterways and railroads. More than 22000 km of roads, over 2000 km of railroads as well as 5 international and 2 local airports are contributing to the sectors development. These facilities are managed and regulated by the Ministry of Transportation of Azerbaijan Republic. According to the Ministry of Transportation of Azerbaijan Republic (2013) Azerbaijan involves some big international projects such as TRACECA for revitalization of the Ancient Silk Way, Baku- Tbilisi-Kars railway etc. Transport routes for gas and oil productions and pipelines such as Baku-Tbilisi-Ceyhan regulated by the Ministry of Transportation, as well. At the end of 2009 the Minister of Transport signed protocol with Korean International Cooperation Agency for the feasibility study of Baku Bay Sea Bridge Project. It is planned that the projected bridge will connect Shykh and Zig settlements of Baku. There is a main point about the turnover goods in transport sector, which reached their pick level in 2009 and 2010.

Based on model result and expert views, the projects and policies in the sector have contributed to sectorial GDP. Experts believe the currently undertaken projects, such as the Baku-Tbilisi Kars railway, Baku-Alat Seaport and TransCaspian routes, will increase GDP. On top of this, there were ideas to cut subsidies to public transport, but not at a cost to customers. These experts promoted establishing an adequate number of public transport companies to increase efficiency and reduce cost via increased competitiveness and thus, dependence on subsidies. Summing up the views of experts, one shall note the following points.

This paper studies Azerbaijan’s economic diversification and assesses sectorial fiscal and monetary policies from the perspective of GDP creation and investment attraction. For this purpose, researchers interviewed and compiled the views of both independent experts and government representatives, who are the only source of the government’s current and future sectorial policies. To check these views against quantitative results, researchers employed three quantitative measures, namely, the Herfindahl-Hirschman Index to measure labour diversification, the Ogive index to measure GDP diversification, and the Vector AutoRegressive model to test sectorial fiscal and monetary policies. Data for these models were taken from the State Statistics Committee, independent experts and different ministries.

As these methods showed, Azerbaijan’s economy is neither labour diversified nor GDP diversified economy. The HHI and Ogive indices jumped when the agricultural & social services sectors (in labour diversification) and the energy industry (for GDP diversification) were introduced into the models. And the higher the index is, the less diversified the economy is.

The most notable results of the VAR model are:

The implications of the models are very close to those of the interviewed experts. Their sectorial recommendations could be summarised as follows:

Banking sector

IT and communication

Construction

Agriculture

Tourism

Transportation

Industry

Having discussed sectorial development potentials and problems, CESD proposes following to achieve economic diversification:

The State Statistical Committee of the Republic of Azerbaijan, 2013. http://www.azstat.org/MESearch/search?departament=22&lang=az. [Online]

Available at: http://www.azstat.org/MESearch/search?departament=22&lang=az

[Accessed 1 August 2013].

AR State Migration Service, 2013. AR State Migration Service. [Online]

Available at: http://migration.gov.az/images/pdf/2df058a1b073d220af0aab3aac9ce0d3.pdf [Accessed 20 August 2013].

Aras, D. N. & Süleymanov, E., 2010. AZƏRBAYCAN İQTİSADİYYATI. 1st ed. Baku: “Şərq-Qərb” Mətbəəsi.

Azerbaijan Today The International Magazine, 2013. http://www.azerbaijantoday.az/. [Online]

Available at: http://www.azerbaijantoday.az/ARCHIVE/21/economics4.html [Accessed 12 August 2013].

Azerbaijan.az, 2013. Azerbaijan Industry. [Online]

Available at: http://www.azerbaijan.az/_Economy/_Industry/_industry_a.htm [Accessed 8 August 2013].

Azerbaijan.az, 2013. ECONOMIC REFORMS. [Online]

Available at: http://azerbaijan.az/portal/Economy/Reforms/reforms_e.html [Accessed 1 August 2013].

Azerbaijan.az, 2013. INDUSTRY SECTOR DEVELOPMENT PRIORITIES IN 2008-2011. [Online]

Available at: http://www.azerbaijan.az/_Economy/_Industry/_industry_e.html [Accessed 8 August 2013].

Azerbaijan24.az, 2013. British Council: Azerbaijan tourism industry lacks reception specialists for hotels and restaurants. [Online]

Available at: http://azerbaijan24.com/component/content/article/1-latest-news/272-british-council-azerbaijan-tourism-industry-lacks-reception-specialists-for-hotels-and-restaurants.html

[Accesse The State Statistical Committee of the Republic of Azerbaijan, 2013. http://www.azstat.org/MESearch/search?departament=22&lang=az. [Online]

Available at: http://www.azstat.org/MESearch/search?departament=22&lang=az [Accessed 1 August 2013].

AR State Migration Service, 2013. AR State Migration Service. [Online]

Available at: http://migration.gov.az/images/pdf/2df058a1b073d220af0aab3aac9ce0d3.pdf [Accessed 20 August 2013].

Aras, D. N. & Süleymanov, E., 2010. AZƏRBAYCAN İQTİSADİYYATI. 1st ed. Baku: “Şərq-Qərb” Mətbəəsi.

Azerbaijan Today The International Magazine, 2013. http://www.azerbaijantoday.az/. [Online]

Available at: http://www.azerbaijantoday.az/ARCHIVE/21/economics4.html [Accessed 12 August 2013].

Azerbaijan.az, 2013. Azerbaijan Industry. [Online]

Available at: http://www.azerbaijan.az/_Economy/_Industry/_industry_a.htm [Accessed 8 August 2013].

Azerbaijan.az, 2013. ECONOMIC REFORMS. [Online]

Available at: http://azerbaijan.az/portal/Economy/Reforms/reforms_e.html [Accessed 1 August 2013].

Azerbaijan.az, 2013. INDUSTRY SECTOR DEVELOPMENT PRIORITIES IN 2008-2011. [Online]

Available at: http://www.azerbaijan.az/_Economy/_Industry/_industry_e.html [Accessed 8 August 2013].

Azerbaijan24.az, 2013. British Council: Azerbaijan tourism industry lacks reception specialists for hotels and restaurants. [Online]

Available at: http://azerbaijan24.com/component/content/article/1-latest-news/272-british-council-azerbaijan-tourism-industry-lacks-reception-specialists-for-hotels-and-restaurants.html [Accessed 3 August 2013].

Bank of England, 2013. Economic models at the Bank of England. [Online]

Available at: www.bankofengland.co.uk [Accessed 15 09 2013].

CBAR Annual Report 2001, 2013. Central Bank of Azerbaijan Republic Annual Report 2001. [Online]

Available at: http://cbar.az/assets/319/2001_yekun.pdf [Accessed 15 August 2013].

CBAR Annual Report 2002, 2013. CBAR Annual Report 2002. [Online]

Available at: http://cbar.az/assets/324/2002_yekun.pdf [Accessed 15 August 2013].

CBAR Annual Report 2003, 2013. CBAR Annual Report 2003. [Online]

Available at: http://cbar.az/assets/331/2003_yekun.pdf [Accessed 15 August 2013].

Annual Report 2001, 2013. Central Bank of Azerbaijan Republic Annual Report 2001. [Online]

Available at: http://cbar.az/assets/319/2001_yekun.pdf [Accessed 15 August 2013].

CBAR Annual Report 2002, 2013. CBAR Annual Report 2002. [Online]

Available at: http://cbar.az/assets/324/2002_yekun.pdf [Accessed 15 August 2013].

CBAR Annual Report 2003, 2013. CBAR Annual Report 2003. [Online]

Available at: http://cbar.az/assets/331/2003_yekun.pdf [Accessed 15 August 2013].

[1] Transformed in this sense is a short abbreviation for Johnson Transformation of the data. The GDP figures and other variables having “T_” abbreviation before their variable names were normalized accordingly to make the VAR eligible. It is requirement of VAR to have input data normalized.

[2] The banking sector is relatively well developed compared to other sectors. However Azerbaijani banks are far behind than the international banks. This is what the researchers mean by underdevelopment.